tax deductions for high income earners 2019

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. For taxable year 2019 the standard deduction increases to 4500 for single taxpayers or married taxpayers filing separately was 3000 and to 9000 for taxpayers who.

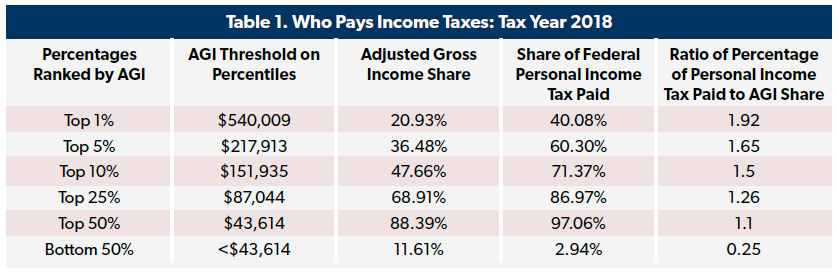

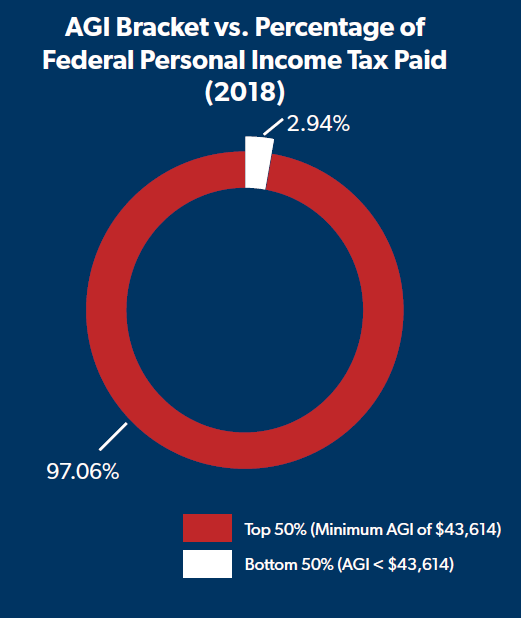

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

How To Reduce Taxable Income For High Income Earners In 2021.

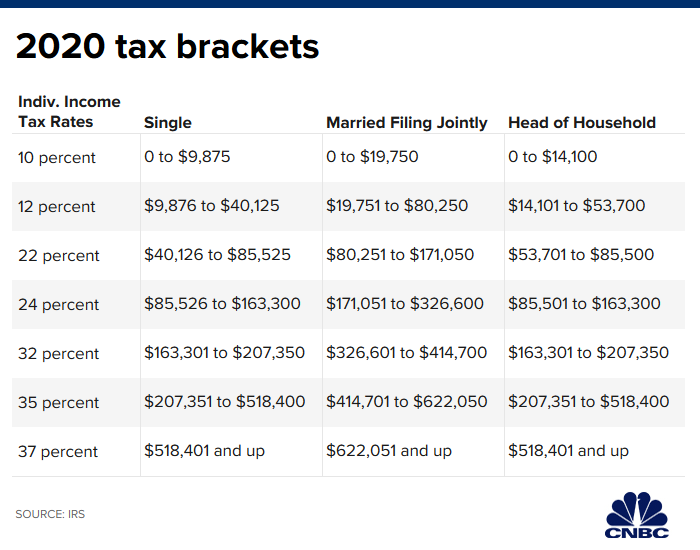

. Higher limits on the percent of income a taxpayer can deduct as charitable contributions. For the sake of this post we consider anybody in the top three tax brackets as a high-income earner. But for many high earners they are unable to fund Roth IRAs due to income limits.

The Medicare payroll tax is 29 which applies to earned income only. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. In this example the IRS allows you to depreciate 100000 a year over the next 275 years as a paper loss.

Tax deductions for high income earners 2019 Tuesday June 14 2022 Edit. Standard deduction of 24000 Fourth Year. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their withholding soon to avoid an unexpected tax.

These include mortgage interest and property tax deductions and deductions for charitable. There are a few different tax deductions for high earners including the mortgage interest deduction the state and local taxes deduction and the charitable donations. Division 293 tax is 15 of your taxable concessional contributions above the 250000 threshold.

For example you have until April 15 2020 to make your 2019 contributions. In general eligibility for the IRA tax deduction hinges on whether youor if youre married your spouseare covered by a retirement plan at work. Consider a 500 donation from a high earner in the 37 tax bracket and a similar donation amount from a taxpayer in the 10 bracket.

Otherwise you pay 145 from each paycheck and. No deduction for those miscellaneous expenses that in prior tax years had to. For 2018 you cannot fund a Roth IRA if your income is 135000 or higher for single filers and.

But the rules may also. If youre self-employed youll pay the full amount. Itemized deductions are gradually reduced for high-income earners as their income increases.

Certain tax breaks begin to phase out the higher your income climbs. The Setting Every Community Up for Retirement. 5 Outstanding Tax Strategies For.

That means that if you earn more than 170050 in gross income as a. In 2019 beneficiaries must pay a coinsurance amount of 341 per day for the 61 st through 90 th day of a hospitalization 335 in 2018 in a benefit period and 682 per day for. The same donation amount will help the high.

2750000275 yrs 100000 Remember the NOI was.

Tax Reduction Strategies For High Income Earners 2022

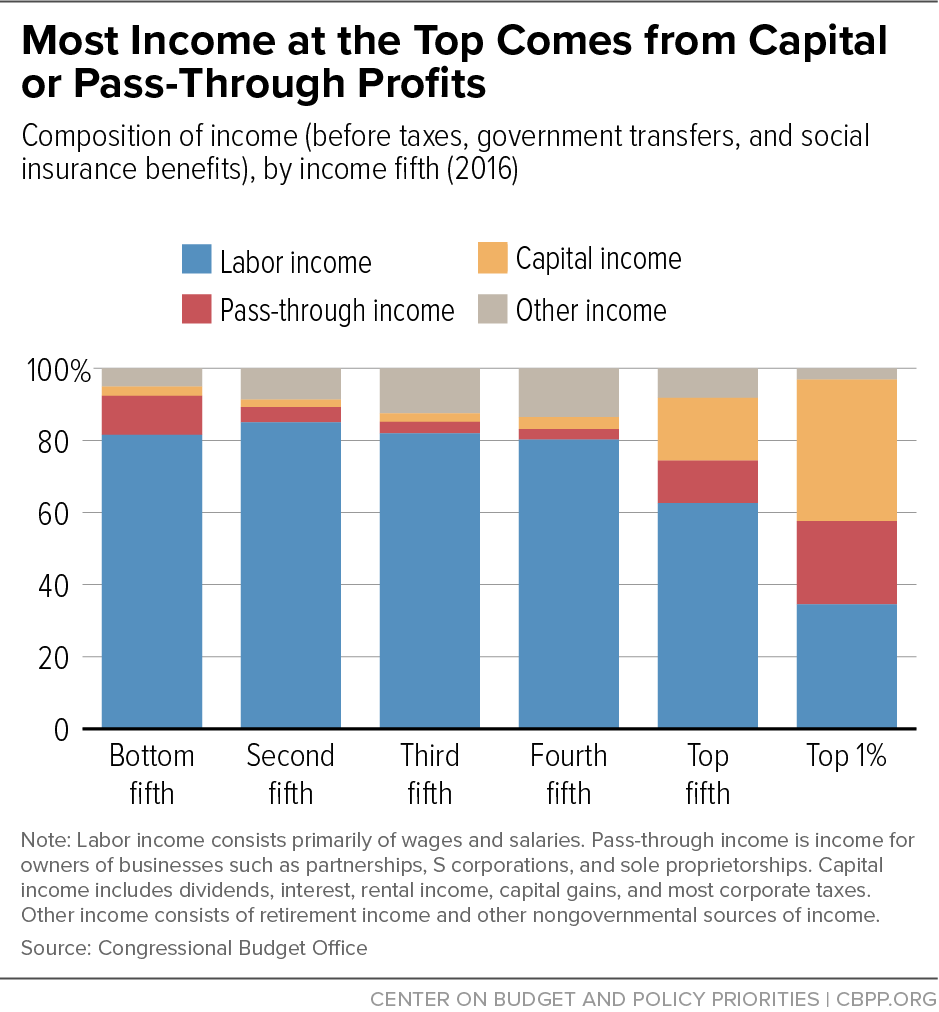

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Racial Disparities And The Income Tax System

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

Who Pays Income Taxes Foundation National Taxpayers Union

Here S A Breakdown Of The New Income Tax Changes

Chiropractic And How To Reduce Taxes For High Income Earners

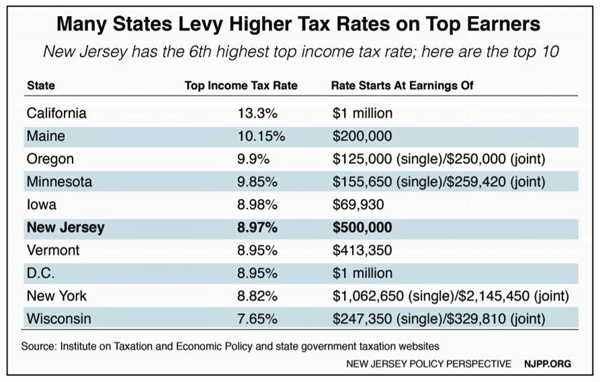

The Provocative Millionaire S Tax Its Potential And Past In N J Whyy

5 Tax Strategies For High Income Earners Pillarwm

Addressing Tax Expenditures Could Raise Substantial Revenue Committee For A Responsible Federal Budget

Retirement Tax Strategies For High Income Earners

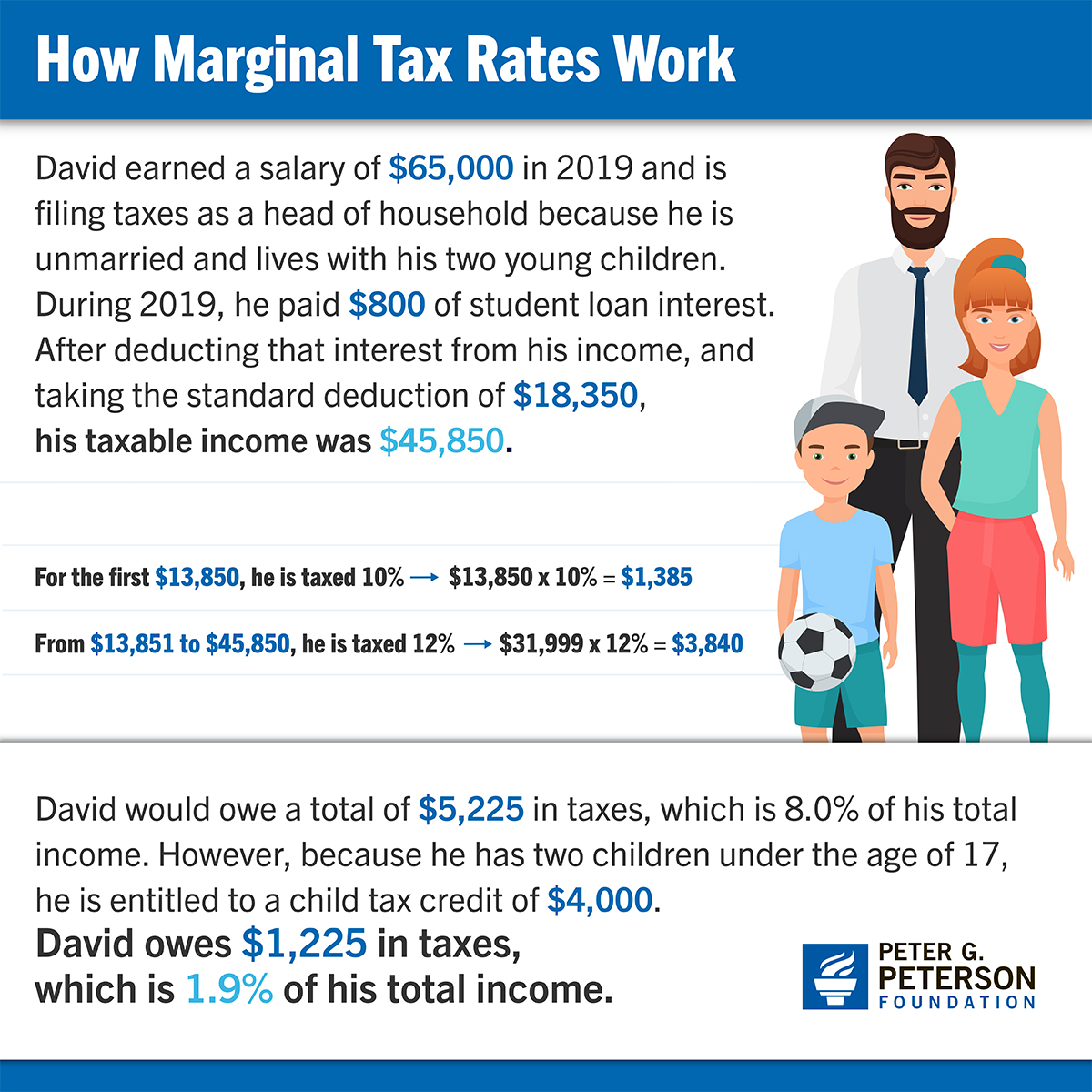

Four Simple Scenarios That Show How Marginal Rates And Tax Breaks Affect What People Actually Pay

How Democrats Would Tax High Income Professionals Not Just The Mega Rich The New York Times

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Who Benefits More From Tax Breaks High Or Low Income Earners

Tax Strategies For High Income Earners Wiser Wealth Management